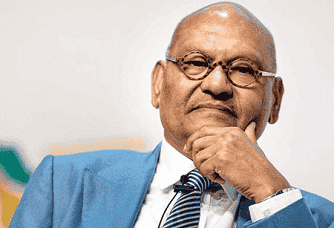

Anil Agarwal, Chairman of Vedanta Ltd, has announced aUSD 20 billion investment plan in India over the next four to five years, underlining the group’s long-term leadership commitment to strengthening the country’s industrial ecosystem.

TheUSD 20 billion investment reflects Vedanta’s confidence in India’s growth trajectory and its own ability to scale operations across metals, energy, oil and gas, and steel.

The announcement comes after the National Company Law Tribunal approved Vedanta’s demerger plan, a key leadership-driven move that will create separate listed companies for aluminium, oil and gas, power, and iron and steel. Vedanta Ltd will continue to house Hindustan Zinc and incubate new businesses, a structure designed to sharpen strategic focus and unlock value across each vertical.

Also Read: How OEMs Can Minimize Manufacturing Risks with Strategic Partnership

Anil Agarwal said aroundUSD 4 billion will be invested in oil and gas, with a similar amount allocated for a greenfield aluminium project. AnotherUSD 2 billion is planned for zinc and silver, while additional capital will be deployed in iron ore, steel, and power assets. He noted that each business has “the potential to be gigantic” and is expected to deliver consistent dividends.

From an industry standpoint, Vedanta plans to double its aluminium and zinc capacity, strengthening its leadership position in domestic metals production. Silver output is projected to increase nearly fourfold to about 3,000 tonnes, supporting both industrial and strategic demand.

In energy and resources, theUSD 20 billion investment includes a target of up to one million barrels per day of oil production and the development of 18,000 MW of power capacity through a mix of thermal and renewable sources. The group is also advancing plans for green steel, aligning industrial growth with sustainability goals and reinforcing Anil Agarwal’s vision for India-led global scale.

We use cookies to ensure you get the best experience on our website. Read more...