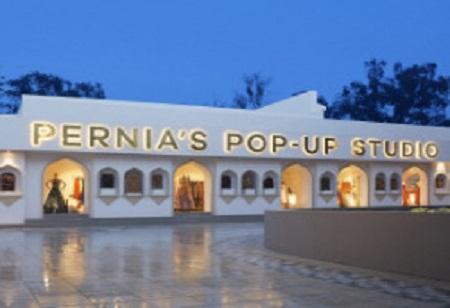

The parent business of Pernia's Pop-Up Shop, a luxury fashion platform, Purple Style Labs (PSL), has submitted its draft red herring prospectus (DRHP) for an IPO to the Securities and Exchange Board of India (SEBI).

There would be no offer-for-sale element to the issue; it will only involve a new equity raise of up to Rs 660 crore. PSL has the option to make a pre-IPO placement of up to Rs 130 crore, which would correspondingly lower the amount of the new offering.

The shares in question will be traded on both the NSE and BSE. Axis Capital and IIFL Capital Services are the book-running lead managers, while Kfin Technologies will act as registrar.

Also Read: Bajaj Electricals Acquires Morphy Richards in Rs 146 Cr Deal

As stated in the DRHP, the largest share of proceeds, Rs 363.3 crore, will be pumped into PSL Retail, a wholly owned subsidiary of the company, for lease obligations related to the establishment and functioning of experience centres and back-end offices in India. A further Rs 128 crore will be spent on sales and marketing initiatives and the balance will be used for general corporate activity.

Leased properties continue to be one of the biggest cost drivers for the company. Earlier this year, PSL rented the historical Ismail Building in Mumbai, which once housed Zara, at a reported rent of Rs 10 lakh per day.

Founder and CEO Abhishek Agarwal have a 27.1% pre-issue stake in the company. Promoter group members Payal Kumari Agarwal and Priyanka Agarwal will own less than 1% between them. Other shareholders include Volrado Venture Partners (2.9%), Singularity Growth Opportunities Fund (1.93%), and Abhinav Agarwal (2.25%).

We use cookies to ensure you get the best experience on our website. Read more...