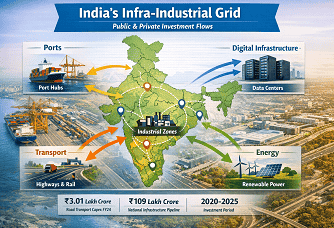

India’s infrastructure investment cycle hit a defining moment in FY24. The Ministry of Road Transport and Highways recorded capital expenditure of INR 3.01 lakh crore, including private investment, underscoring how public spending is now anchoring large pools of private capital. This surge is not limited to highways. It is reshaping investment flows across power, logistics, ports, data centers, and industrial corridors, creating a tightly linked infra-industrial grid that is changing how capital is deployed in India.

This grid matters because infrastructure now drives investment decisions across sectors. Manufacturing, logistics, energy, and digital services are no longer separate bets. They are linked assets, built in clusters, financed over long horizons.

The backbone of the grid is government-led capital formation. The National Infrastructure Pipeline, with an estimated INR 111 lakh crore outlay, created visibility for investors. Roads, railways, and urban infrastructure absorb the largest share, but their real value lies in spillovers.

Union Road Transport and Highways Minister Nitin Gadkari has repeatedly stressed this multiplier effect, saying, “Every rupee invested in infrastructure generates three rupees of economic growth.” That logic explains why highways and logistics corridors are being built ahead of demand. They lower freight costs, raise asset productivity, and pull private factories closer to consumption centers.

States are now competing on execution. Faster land acquisition, digital approvals, and logistics policies are shaping where capital lands. Commerce and Industry Minister Piyush Goyal noted this shift when he said, “States along with the private sector must develop action plans for better logistics business to attract investments.” The grid is no longer just national. It is deeply regional.

Also Read: How Integrated Logistics Hubs Are Reshaping Regional Trade

Large business groups are aligning their investment plans with these public corridors. Energy, ports, cement, and data infrastructure are being planned as integrated systems rather than stand-alone assets.

Adani Group chairman Gautam Adani framed this approach clearly in a recent investor address saying that they are an infrastructure company, which positions them to capture opportunities across energy, transport, and logistics together. This reflects a broader market reality. Scale lowers financing risk. Integrated assets improve returns.

Global capital is also flowing in. Pension funds, sovereign wealth funds, and insurers prefer Indian infrastructure because revenue visibility has improved. Toll roads, transmission assets, and renewable projects now offer predictable cash flows backed by regulation and long-term contracts.

What makes the current cycle different is the rise of digital infrastructure as a core asset class. Data centers, cloud regions, and fiber networks now sit alongside roads and power lines.

Microsoft’s USD 17.5 billion commitment to India illustrates this shift. Announcing the investment, CEO Satya Nadella said, “We are committed to building the infrastructure, skills, and sovereign capabilities India needs for its AI future.” This is not just a tech play. Data centers drive demand for power, land, construction, and skilled labor - anchoring entire industrial ecosystems.

As digital services expand, physical and digital infrastructures are converging. Manufacturing plants depend on cloud systems. Logistics runs on data. Capital follows that integration.

India’s data center market offers a clear example of the new grid in action. Large campuses are being developed near Mumbai, Chennai, and Hyderabad, close to submarine cable landings and power hubs. Public investment in transmission and urban transport reduces project risk. While private capital funds the high-capex facilities.

These campuses generate steady dollar-linked revenues while supporting local industries. Construction firms, equipment suppliers, and renewable developers all benefit. Over time, nearby industrial parks and tech clusters emerge. The grid effect compounds.

Also Read: Smart Factory Strategies for Agile Electronics Manufacturing

Market analysts increasingly view infrastructure as India’s most stable long-term investment theme. Edelweiss Mutual Fund CEO Radhika Gupta has said that infrastructure assets are well suited for long-term institutional investors because of their stable and predictable cash flows. That view explains the rise of infrastructure investment trusts and green financing platforms.

The new infra-industrial grid is not about one sector winning. It is about alignment. Public money builds confidence. Private capital builds scale. Digital and physical assets grow together.

For investors, the message is direct, i.e., India’s growth story is now mapped in concrete, steel, and code. Those who understand how these flows connect will understand where the next decade of returns will come from.

It is the combined system of roads, power, ports, logistics, and digital infrastructure that supports industrial and commercial activity. These assets are now planned and financed as linked networks rather than separate projects.

Higher government capital spending has improved project visibility and execution. This has reduced risk and encouraged private and institutional investors to commit long-term capital to infrastructure assets.

Investors gain access to long-term assets with stable cash flows. Businesses benefit from lower transport costs, better power access, and improved connectivity, which support expansion and efficiency.

We use cookies to ensure you get the best experience on our website. Read more...