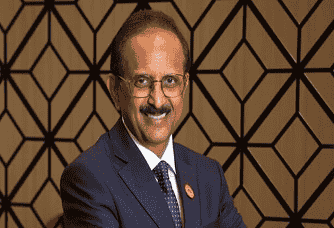

C S Setty, chairman of State Bank of India, says the bank is riding a strong wave of credit demand, with corporate loans picking up pace and set for double-digit growth this financial year.

He notes that steady liability management will help the bank hold its margin above 3 percent, even as the policy environment stays uncertain.

Speaking in Mumbai, Setty explained that the upcoming Monetary Policy Committee review will hinge on growth and inflation trends, not on deposit mobilization. “For the policy repo rate, I don’t think they (the RBI) are looking at deposit mobilization. The policy rate is dependent on the dynamics of growth and inflation — at least that’s what classical monetary theory says,” he said.

Also Read: Advancing India’s Manufacturing Realm Toward Global Resilience

Setty pointed out that the second quarter delivered robust economic expansion, while inflation stayed modest. But he also warned that low food prices — a key reason behind the softer inflation print — could reverse quickly. This leaves the Reserve Bank of India cautious as it weighs its next move.

He added that before the latest GDP numbers were released, a rate cut seemed like a “close call.” With stronger-than-expected growth now in the picture, expectations have shifted. “I think the robust growth rate is going to be a communication challenge for monetary policy in case the rate cut has to happen,” he said.

For now, the industry anticipates a pause, though the final decision will rest on the RBI’s view of the inflation path. Setty’s outlook shows how State Bank of India is positioning itself amid a complex policy backdrop while continuing to benefit from rising credit demand.

We use cookies to ensure you get the best experience on our website. Read more...