Banks flush with funds are willing to lend for short-term, especially because there are not enough good lending opportunities because of slowdown

An environment of risk aversion financial markets are prone to, non-banking financial companies (NBFCs) and Housing Finance Companies (HFCs) are loping helter-skelter for raising funds from mutual funds, insurance companies and the banks. The funds are required for refinancing existing loans and also for fresh lending.

Mumbai-headquartered Indiabulls Housing Finance Limited has witnessed quite a success in gathering close to Rs. 2,000 Crore from leading public sector banks (PSBs) by means of non-convertible debentures (NCDs) in the last two months. Interesting fact is, only the PSBs have extended a helping hand.

India’s largest PSB, the State Bank of India (SBI) mobilized this latest fund raise for Rs 250 crore on private placement basis. The tenor of the NCDs is for 548 days, while the redemption date is

December 2021 with a rate of interest at 9 per cent. Bank of Baroda has pledged the maximum of Rs 730 crore followed by Indian Bank offering Rs 325 crore. Moreover, Canara Bank and Union Bank of India have invested Rs 200 crore each. Punjab National Bank and Central Bank of India are among other public sector banks that have invested in the non-convertible debentures of the housing finance company.

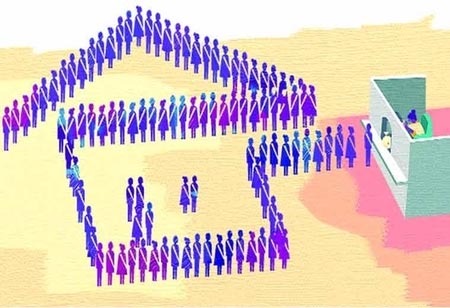

These unsecured NCDs are fraction of the company's outstanding borrowings of Rs 33,500 crore plus. The borrowings too are around the same amount. Banks abundant with funds are keen to lend for short-term, especially because there are not enough good lending opportunities because of slowdown in economy and disruption introduced by coronavirus lockdown. The HFCs with secured mortgage business make a good lending proposition for banks seeking to earn a good revenue along with safety of investment.

The last 2 years have given challenging times for the Rs 30 lakh crore NBFC sector. The firm has faced rough tides since the debacle of infrastructure financing institution in September 2018. Mutual funds, insurance companies and banks, especially private sector banks are experiencing risk aversion. The jolt from coronavirus has not only complicated fund mobilisation, or the liabilities side, but is also expected to direct to some surprises on the asset side. Falling growth, job losses and decline in income will significantly impact credit worthiness of individual borrowers.

Promoted by Sameer Gehlaut, Indiabulls Housing has a balance sheet size of around Rs 1 lakh crore. The 74.93 per cent public shareholding market capitalisation of the company, is worth Rs 9,626 crore. Over 10 per cent stake in the company is owned by LIC. Post the Covid outbreak, the senior management team have shook on to take an average salary cut of 35 per cent in 2020-21. While the Chairman Gehlaut has decided not to take any salary, Gagan Banga (vice chairman, MD & CEO) has taken a substantial 75 per cent salary cut in the current year.